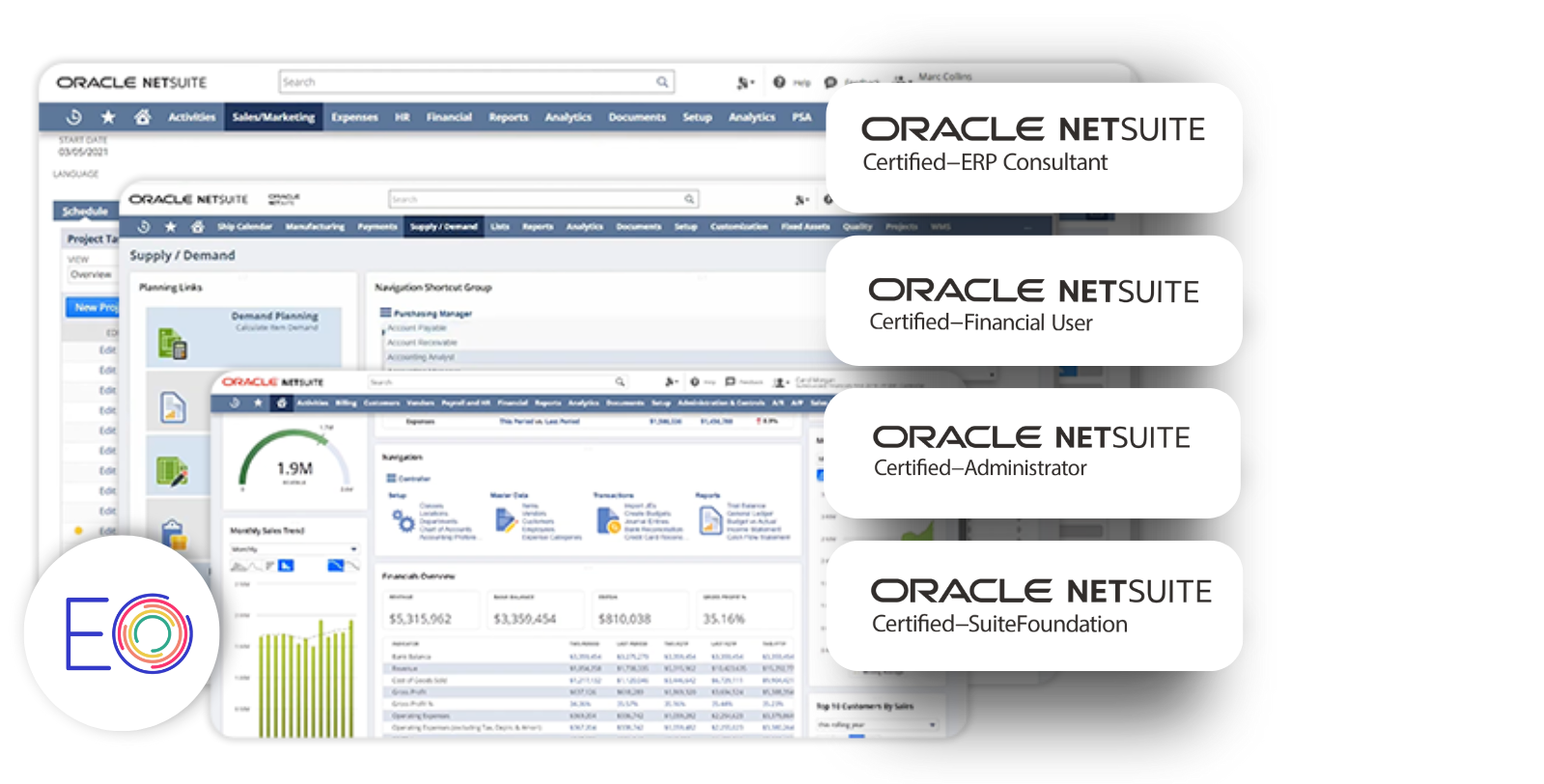

NetSuite Bookkeepers

Our NetSuite-certified bookkeepers can help you streamline processes for accurate and compliant financial records.

Thank you for getting in touch!

One of our colleagues will get back to you shortly.

Have a great day!

Why Partner with a Certified NetSuite Bookkeeper?

We empower your business with reliable data to draw meaningful insights by providing the following services.

Accurate financial reporting

Our team conducts regular reconciliations to ensure your books match bank records, for a smoother tax filing process.

Data maintenance

We review, clean up and migrate data, to consolidate information from multiple sources for consistency. Our goal is to stabilize and safeguard against non-compliance.

NetSuite bookkeeper services

From performing day-to-day financial tasks like capturing transactions, managing accounts, and performing reconciliations, our experts provide your business with ongoing support. We have decades of experience with NetSuite systems and can become your partner in overall financial management.

This includes:

Processing invoices, payments, and receipts

Managing accounts payable and receivable

Recording transactions and reconciling records

Preparing financial statements

Managing payroll reconciliations for compliance

Assisting with tax preparation and filing

Frequently Asked Questions

Our team can help you make the most of NetSuite’s functionality. We use our expertise and knowledge to help safeguard you against compliance issues while saving your business time and money. That way, you can focus more on core operations without getting weighed down by financial management. A CPA has a more strategic and high-level role. In addition to financial reporting and analysis, they can help with consulting and advisory services, financial management, tax planning, and forensic accounting. Signs your business is in need of dedicated controller services: You are experiencing rapid growth. Your business is experiencing constant account-related errors or inconsistencies. Top management is getting too involved in accounting-related queries, taking them away from core operations.

A bookkeeper, also called a controller, takes care of your business’ record-keeping and accounting requirements. Their primary focus is to ensure regulatory compliance. A CPA has a more strategic function. In addition to financial reporting, they can help with data analysis for financial forecasting, tax planning, and forensic accounting.

No! Our team helps to streamline financial management and maintain ultimate control of your finances. Consider us a partner to your internal team.

Yes. Our clients feature businesses of all sizes, across a range of industries. As such, we can offer you tailored services.